- Labour may impose VAT on private school fees starting January 2025.

- Tories argue this will cause disruption, forcing students to leave private schools.

- Shadow Education Secretary Bridget Phillipson claims schools had ample preparation time.

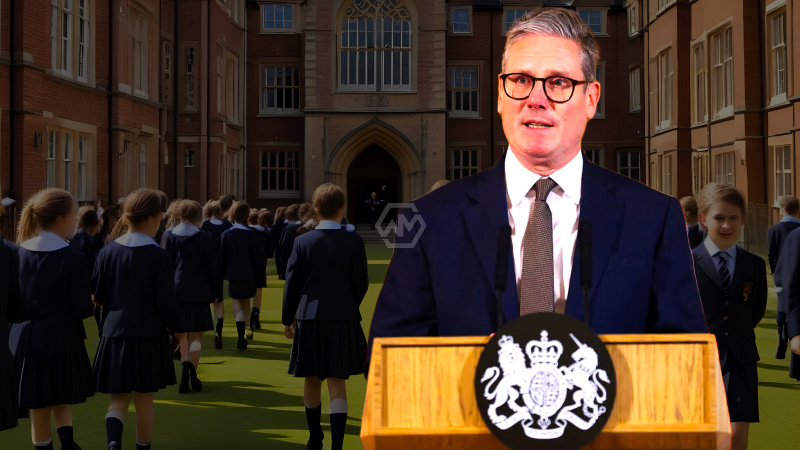

Labour’s plan to impose VAT on private school fees might take effect in January 2025, months earlier than originally anticipated. Bridget Phillipson, the Education Secretary, argues that schools have had enough time to prepare.

However, the Tories believe that this policy shift will lead to significant disruptions, potentially forcing many students to transition from private to state schools mid-academic year.

Concerns Over Labour’s Accelerated Private School Tax Policy

Damian Hinds, the shadow education secretary, has expressed strong opposition, warning that the accelerated timeline will exacerbate the chaos already expected from the policy. He suggests that without proper plans to accommodate an influx of students into state schools, both sectors could suffer. The Tories intend to hold Labour accountable for any negative outcomes resulting from this move.

Damian Hinds has been vocal in his criticism, warning that the policy could lead to chaos across the education system. The shadow education secretary argues that the lack of a clear plan to handle a potential surge in state school enrollments could overwhelm the public education sector. This issue is poised to become a significant point of contention between the two parties as the implementation date approaches.

Labour’s proposed imposition of VAT on private school fees, now potentially set for January 2025, has drawn sharp criticism from the Tories. Bridget Phillipson, Labour’s Education Secretary, asserts that schools have been given adequate notice and time to prepare for this change. She emphasizes the urgency of implementing the policy to address educational inequalities. However, the Tories argue that this timeline is too abrupt and could lead to widespread disruption within the education sector.

Damian Hinds, the shadow education secretary, contends that the accelerated timeline will only exacerbate existing challenges. He warns that many private school students may be forced to move to state schools, creating logistical and financial pressures on the public education system. Hinds criticizes Labour’s approach as ideologically driven and lacking in practical foresight, suggesting that the government is not adequately prepared for the potential fallout.

The potential early implementation of VAT on private school fees is a significant shift from Labour’s original timeline, causing alarm among educators and parents alike. The Tories are particularly concerned about the mid-academic year change, which they believe could lead to chaos as schools and students scramble to adjust. They argue that such a move requires more thorough planning and a phased approach to minimize disruption.

Labour maintains that the policy is necessary to ensure fairer funding across the education system. Bridget Phillipson has stated that the additional tax revenue will be used to support state schools and address disparities. Despite these assurances, the Tories remain skeptical, arguing that the potential for mass migration of students to the state sector has not been fully considered. The debate highlights the broader ideological divide between the parties on education policy and funding.

As Labour pushes forward with its plan to impose VAT on private school fees sooner than expected, the education sector braces for potential upheaval. The ensuing debate underscores significant ideological differences between Labour and the Conservatives regarding education policy and fiscal priorities.

“Labour’s education tax policy will be disastrous for pupils across the country.” — Damian Hinds