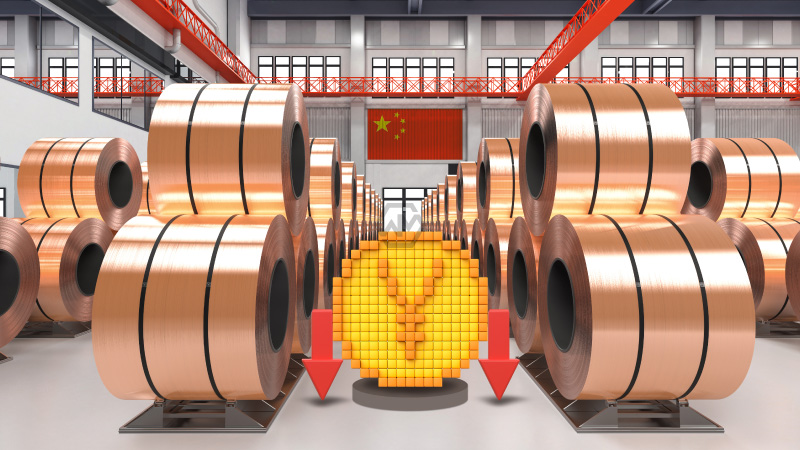

Copper costs fell on Friday as financial backers stressed easing back monetary development and China’s yuan kept on debilitating, making dollar-evaluated metals costlier for purchasers on the planet’s greatest products market.

Benchmark copper CMCU3 on the London Metal Trade (LME) was down 1.2% at $7,639 a ton by 0955 GMT, heading for a week-by-week drop of around 3%.

China Yuan Downs

Costs of the metal utilized in the power and development enterprises have tumbled 30% from a top in Spring yet have held around $7,500-$8,000 since July.

“Pushing copper down are cash elements coming from a more grounded dollar and a more fragile yuan,”

said Gianclaudio Terlizzi, an accomplice at experts T-Item.

- In any case, he added that tight stock in China would keep costs around current levels.

- China’s Yuan going down day by day.

- It also affects the price of copper too.

“China’s economy stays powerless and is as yet not offering any valid justification to go long metal. However, it is extremely dangerous to go short,” he said.

The yuan has fallen by around 4% against the dollar in the previous month and on Friday slipped past the mentally significant degree of 7 yuan to the dollar without precedent for two years.