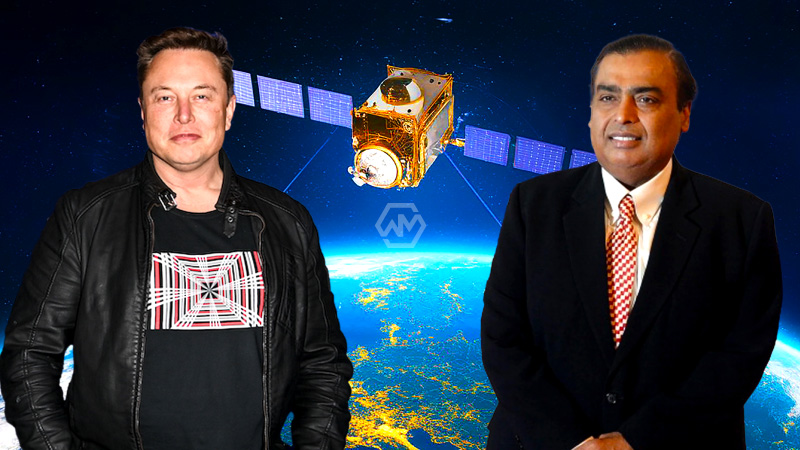

- Elon Musk‘s Starlink and Mukesh Ambani’s Reliance Jio are vying for dominance in India’s satellite broadband market.

- India’s recent regulatory shift to administratively allocate satellite spectrum has intensified the competition.

- Analysts predict a pricing war as both billionaires aim to capture a market projected to reach two million subscribers by 2025.

In the fast-evolving landscape of India’s satellite broadband market, the competition between Elon Musk’s Starlink and Mukesh Ambani’s Reliance Jio is poised for a significant showdown.

Reliance Jio, having invested heavily in the telecom sector, argues that an auction system is essential for ensuring fair competition.

The High-Stakes Race for Satellite Broadband in India

As India strives to expand its digital infrastructure, the competition between Elon Musk’s Starlink and Mukesh Ambani’s Reliance Jio underscores the importance of innovative broadband solutions. With the Indian government’s recent decision to allocate satellite spectrum administratively, Musk sees an opportunity to enter a market that has long been hindered by regulatory barriers. Starlink’s technology promises faster internet access in rural and remote areas, addressing a critical need in a country where traditional services often fall short.

On the other hand, Ambani’s Jio has established a formidable presence in the Indian telecom sector, supported by significant investments in terrestrial networks. The company argues that an auction process is necessary to ensure a level playing field, allowing it to maintain its competitive edge against emerging satellite players. Jio’s partnership with SES Astra aims to provide affordable satellite services while emphasizing the need for regulatory clarity in the evolving broadband landscape.

With approximately 2 million satellite internet subscribers projected by 2025, both companies recognize the lucrative potential of this market. The stakes are high as they navigate the complexities of pricing strategies, regulatory challenges, and the technological differences between LEO and MEO satellite systems. The upcoming battle is not just about broadband; it also reflects broader themes of competition, investment, and the future of digital access in India.

As the competition intensifies, the impact on consumers will be significant. A price war is expected, with both companies vying for market share in a country where affordability is crucial. The outcomes of this rivalry will not only shape the future of internet access in India but also influence global trends in satellite broadband technology.

The clash between Musk and Ambani highlights the potential for satellite broadband to transform internet access in India, setting the stage for an exciting and competitive market landscape.

“The battle between two of the world’s richest men over the internet of space has truly begun.”