- Crypto mining activities that produce their power will be exposed to this assessment.

- The 30% rate will apply to the assessed expenses of their power utilization, whether or not they are associated with the matrix or not.

- This incorporates those using environmentally friendly power sources, for example, sun-based or wind power.

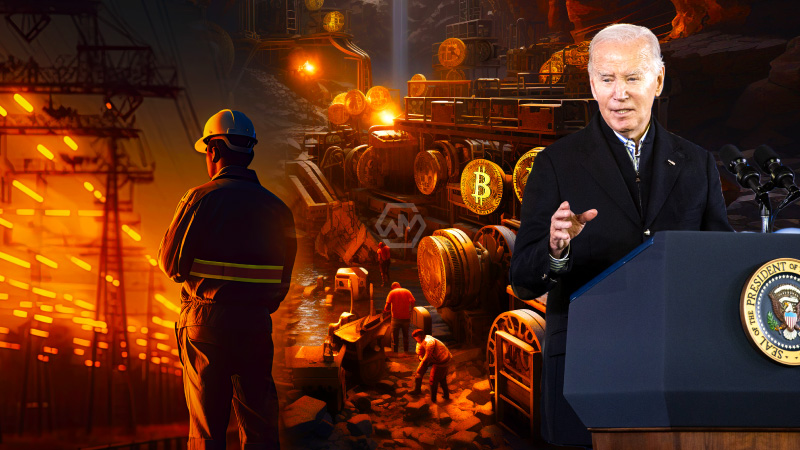

In his spending plan proposition for 2025, President Joe Biden is returning to the idea of forcing a 30% duty on the power utilization of digital currency mining tasks.

This drive is illustrated in the “General Clarifications of the Organization’s Financial Year 2025 Income Recommendations,” a U.S. Branch of the Depository record.

30% Tax on the Crypto Mining Electricity

The archive condemns the absence of current regulation explicitly tending to the tax assessment from advanced resources, besides intermediary and money exchange detailing.

To redress this, the Biden organization proposes an extract charge on the power utilized in mining advanced resources, similar to charges on actual products like fuel.

Under this proposition, crypto-mining substances would be expected to reveal both the amount and sort of power they consume.

For power purchased remotely, firms should likewise report its worth, which will then be utilized as the reason for the expense.

Likewise, excavators renting computational power should pronounce the power’s worth given by the renting organization.

This action, planned to produce results from January 1, 2025, plans a staged duty presentation: beginning at 10% in the principal year, 20% in the second, and arriving at 30% in the third year.

Pierre Rochard of Mob Stages has condemned the move as an endeavor to subvert Bitcoin and work with the send-off of a national bank computerized money (CBDC).

U.S. Congressperson Cynthia Lummis has communicated her resistance to the duty on X, recommending that while the organization’s consideration of crypto in the spending plan might demonstrate an uplifting perspective on digital currency, the proposed expense could essentially hurt the business situation in the U.S.

This drive denotes Biden’s second endeavor to carry out a 30% duty on the power utilized by crypto excavators, following a comparative proposition in the 2024 spending plan proposition reported on Walk 9, 2023.