- Dr. Zakari Mumuni of the Bank of Ghana urges Africa-wide cooperation on cyber resilience in the financial sector.

- Emphasizes cybersecurity as foundational to financial inclusion and trust in digital financial services.

- Highlights Ghana’s leadership in regulation, threat detection, and gender-inclusive finance initiatives.

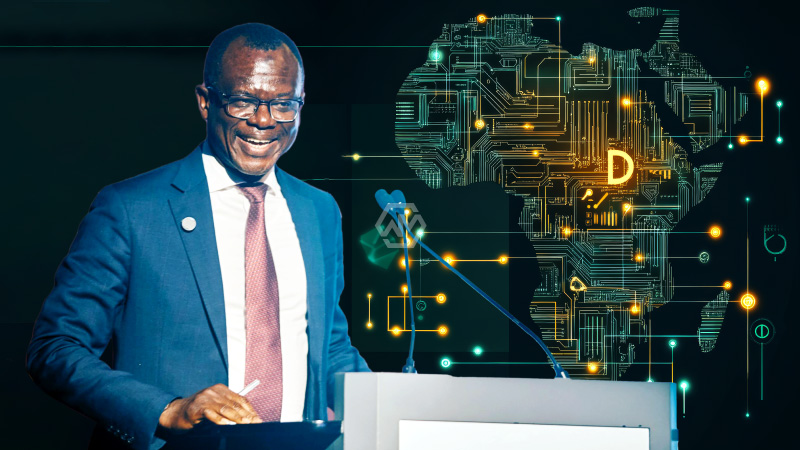

In an era of rapid digital transformation, Dr. Zakari Mumuni, First Deputy Governor of the Bank of Ghana (BoG), has issued a clarion call for pan-African collaboration to combat the growing threat of cyber attacks on financial institutions.

Highlighting Ghana’s proactive approach, Dr. Mumuni revealed that over 40 financial institutions have been integrated into a real-time Financial Industry Security Operations Center, enabling rapid threat detection and response.

Cybersecurity at the Core: How Ghana Is Leading Africa’s Fight for a Safer Financial System

Dr. Mumuni underscored that cybersecurity must be embedded within financial inclusion strategies—not as an afterthought, but as a core foundation. With the rise of mobile money, agency banking, and digital credit, the African continent is experiencing an unprecedented financial revolution. However, these innovations simultaneously open the door to sophisticated cyber threats, potentially undermining the very progress they enable.

To respond effectively, regulators must balance their dual role: promoting inclusion while protecting infrastructure integrity. Ghana is actively assessing the cybersecurity maturity of financial institutions using international benchmarks. Alarmingly, over 40% of assessed institutions in 2024 exhibited critical vulnerabilities, especially in areas like access control and incident response—underscoring the need for more rigorous supervision and enforcement.

Dr. Mumuni advocated for cross-border cooperation, urging African nations to harmonize cybersecurity policies, share intelligence, and adopt early-warning systems. “Resilience of one is the protection of all,” he noted. Through regional peer learning, scenario-based preparedness drills, and proportionate fintech regulation, Africa can collectively respond to the evolving threat landscape.

Ghana’s cybersecurity strategy also supports broader economic goals, such as gender-inclusive finance. As a member of the African Development Bank’s AFAWA initiative, Ghana is planning to launch a Women’s Development Bank with GH¢51 million in seed funding by 2025. This initiative aims to close the credit gap faced by women-led businesses, particularly in agriculture, technology, and informal sectors, proving that digital trust and economic equity must go hand-in-hand.

Africa’s financial future hinges not just on digital access, but on digital security. By building collective resilience, countries can foster an inclusive system built on trust, stability, and shared strength.

“The strength of the team is each individual member. The strength of each member is the team.” — Phil Jackson

This reflects the essence of Dr. Mumuni’s call for continental unity in cybersecurity to protect Africa’s digital financial systems.