- Dubai, specifically, has beaten, its benchmark record flooding 20% this year, driven by an ascent in property-related shares.

- Dubai Taxi denotes the city’s second Initial public offering of 2023, following the fruitful posting of Al Ansari Monetary Administrations PJSC in the Spring.

- Exchanging is set to initiate on December 7.

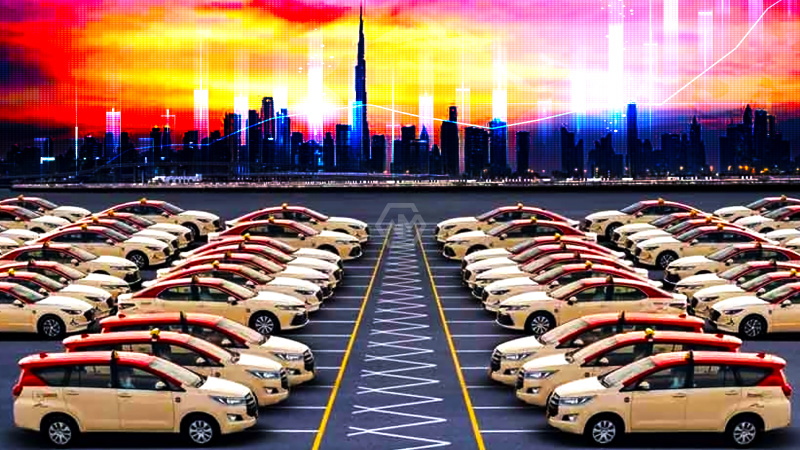

Dubai Taxi Co. has established a standard for financial backer interest in its $315 million first sale of stock (Initial public offering), getting more than 150 billion dirhams ($41 billion) in orders, denoting the most elevated oversubscription level ever for a Dubai Initial public offering.

As per Bloomberg, the Initial public offering, Dubai’s most memorable privatization in north of a year, got overpowering revenue, with the institutional financial backer tranche almost multiple times oversubscribed.

Dubai Taxi Co. Set a Record for Investors

The public authority of Dubai sold a 25 percent stake, adding up to 624.75 million offers, at 1.85 dirhams each, the top finish of the showcased range, esteeming Dubai Taxi at 4.62 billion dirhams.

This interest in Dubai Taxi’s Initial public offering features the unmistakable difference between the flourishing postings market in the Bay district and the stifled worldwide opinion, set apart by difficulties like exorbitant loan fees and market unpredictability throughout recent years.

The Inlet district, floated by raised oil costs, vigorous nearby financial backer interest, and government drives to list state-claimed organizations, has turned into a focal point for Initial public offerings.

The financial backer interest for Dubai Taxi’s Initial public offering adds to the Bay’s champion exhibition in postings this year, with roughly $8.4 billion brought through Initial public offerings up in the district, representing over 33% of the absolute posting volumes in Europe, the Center East, and Africa.

Dubai’s progress in raising $8.3 billion through stake deals in state-claimed organizations in 2022 highlights its obligation to post state-possessed substances, lining up with comparative drives in Abu Dhabi and Riyadh.